Beneficiary Designation Gifts

Donating part or all of your unused retirement assets, such as your IRA, 401(k), 403(b), pension, or other tax-deferred plan, is an excellent way to make a gift to the charity of your choice.

If you are like most people, you probably will not use all of your retirement assets during your lifetime. You can make a gift of your unused retirement assets to help further our mission.

Benefits of gifts of retirement assets

- Simplify your planning.

- Support the causes that you care about.

- Continue to use your account as long as you need to.

- Heirs can instead receive tax-advantaged assets from the estate.

- Receive potential estate tax savings from an estate tax deduction.

How to make a gift of retirement assets

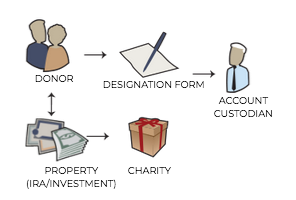

To leave your retirement assets to your chosen charity, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate your chosen charity as beneficiary, they will benefit from the full value of your gift because your retirement assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

Future gifts from your retirement assets

Did you know that 40%-60% of your retirement assets may be taxed if you leave them to your heirs at your death? Another option is to leave your heirs assets that receive a step-up in basis, such as real estate and stock, and give the retirement assets to the charity of your choice. As a charity, they are not taxed upon receiving an IRA or other retirement plan assets. You can use the “Make a Future Gift of Retirement Assets” tool to contact your retirement plan custodian and designate a future gift to your chosen charity.